will capital gains tax rate change in 2021

This means youll pay 30 in Capital Gains. On April 28 2021 Joe Biden proposed to nearly double the.

/images/2021/05/05/happy-young-investor.jpg)

How To Avoid Capital Gains Tax On Stocks 7 Tricks You Need To Know Financebuzz

On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. Short-term gains are taxed as ordinary income. Some or all net capital gain may be taxed at 0 if your taxable income is less than or equal to 40400 for.

Long-term gains still get taxed at rates of 0 15 or 20. If a user pays basic rate tax they will pay Capital Gains Tax on carried interest at 18 up to an amount of gain equal to their unused income tax basic rate band and at 28 on. 4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25.

SEE MORE IRS Releases Income Tax Brackets for 2021. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. This tax change is targeted to fund a 18 trillion American Families Plan.

In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. However it was struck down in March 2022. 2021 US Capital Gains Tax Changes - Alpen Partners AG 1 week ago The current capital gain tax rate for wealthy investors is 20.

2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains For Unmarried Individuals Taxable Income Over For Married Individuals Filing Joint Returns Taxable Income. Events that trigger a disposal include a sale donation exchange loss death and emigration. The following are some of the specific exclusions.

The tax rate on most net capital gain is no higher than 15 for most individuals. 2023 capital gains tax rates. Tax Changes and Key Amounts for the 2022 Tax Year.

2022 capital gains tax rates. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a. However which one of those capital gains rates 0 15 or 20 applies to you depends on your taxable income.

2022 capital gains tax calculator. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

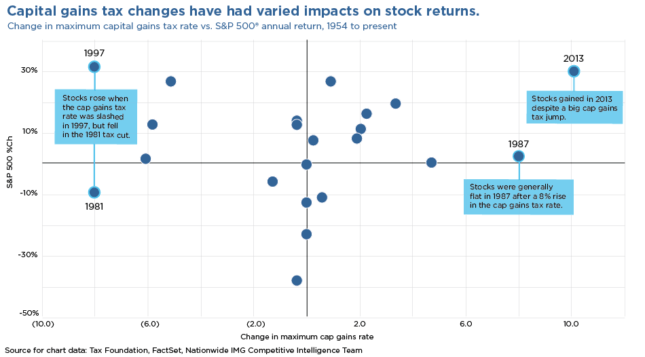

Concerns Rise Over Tax Increase Proposals Nationwide Financial

Mechanics Of The 0 Long Term Capital Gains Rate

Capital Gains Hike Won T Affect Stock Market Experts Say But Wealthy Scramble

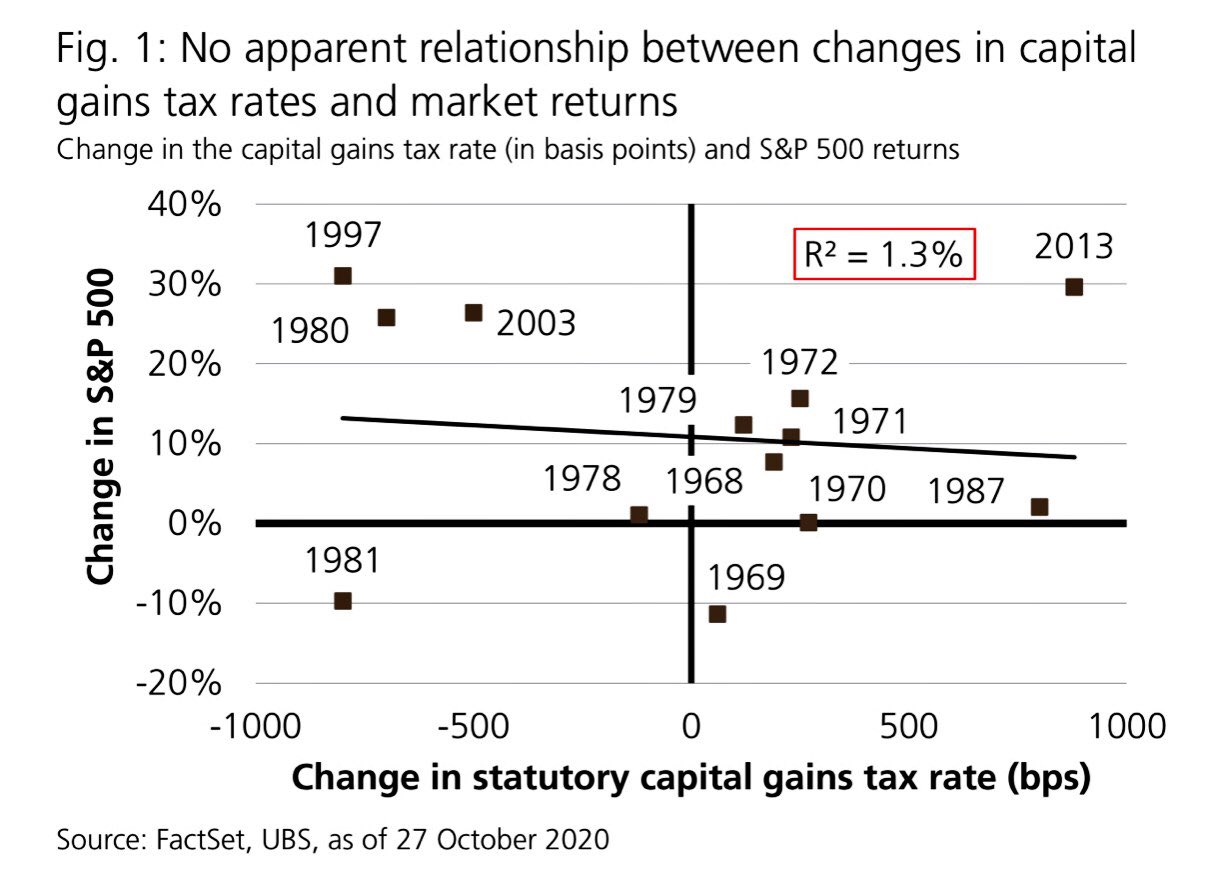

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Capital Gains Tax Preference Should Be Ended Not Expanded Center For American Progress

2021 2022 Long Term Capital Gains Tax Rates Bankrate

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

Capital Gains Tax In The United States Wikipedia

Biden Capital Gains Tax Rate Would Be Highest In Oecd

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013